Vertex for e-Commerce Overview

Read a high-level overview of the service and its components.

Vertex for e-Commerce automates online VAT, GST, and US sales tax calculations in real time. Applying accurate customer location determination and taxability rules across multiple countries and regions at the point of sale, Vertex for E-Commerce provides in-depth reports that you can use to remit your own taxes where you have a tax obligation.

This service offers the following benefits to your business:

- Automated indirect tax compliance to protect the buyer’s checkout experience

- Single solution for indirect tax compliance across all stages of the sales flow, in all markets

- Profit protection, by avoiding tax calculation errors or non-compliance penalties

- Simple API integration facilitating speedy implementation and delivering value quickly

- Reliability, ensuring availability and accuracy

- Modularity that is tailored to the needs of the user, both now and in the future

Component overview

You can deploy Vertex for e-Commerce, or you can deploy Vertex Validator as a standalone application. Some components are unique to each and some are common to both.

Vertex for e-Commerce

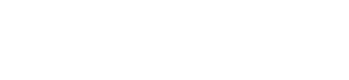

Vertex for e-Commerce consists of the following components:

- Seller Transaction API: This is the API that you use to integrate the service with your store or applications. It provides liability and tax calculation as well as other services. You can use it to model your transactions. See API Overview.

- Vertex Validator: This component validates Tax IDs and helps with processing of Business-to-Business (B2B) transactions. See Vertex Validator.

- Vertex Invoice IQ: This component helps ensure that compliant invoices are generated. See Vertex Invoice IQ.

- Dashboard: The Dashboard is a UI that contains reports and settings. See Dashboard Overview.

These components are integrated with the API and the Tax Calculation Engine to ensure that you get all the features you need from a single API integration.

The following graphic shows this a standard deployment of Vertex for e-Commerce, where Vertex Validator is integrated alongside it:

Vertex for e-Commerce Components

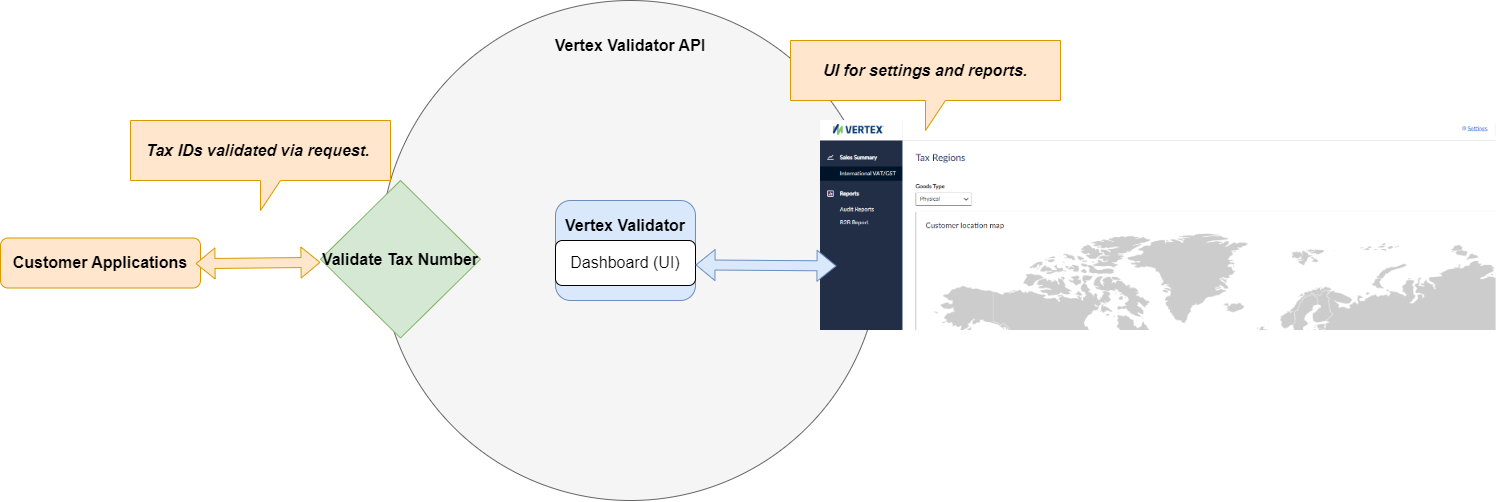

Standalone Vertex Validator

The standalone version of Vertex Validator includes the following components:

- Standalone Tax ID Validator API. This API allows for a simplified integration for standalone users. More information is provided in the Standalone Vertex Validator topic.

- Dashboard: These users can also access the UI for settings and reports.

The following graphic shows a standalone deployment of Vertex Validator:

Standalone Validator

Integration overview

You use the REST APIs to integrate the service with your applications.

Vertex for e-Commerce

An introduction to the Seller Transaction API is provided in the Getting Started with the APIs topic and subsections.

You use the Seller Transaction API to model your transactions. This is described the Transaction Modeling section.

Vertex Validator

Vertex Validator can be integrated as part of Vertex for e-Commerce, as explained in the Integrated Vertex Validator topic. You use the buyer_tax_number field in your Store Transaction requests.

You can also use Vertex Validator on its own, as explained in the Standalone Vertex Validator topic. You use the Validate Tax Number request to validate your Tax IDs.

Restrictions

The following restrictions apply:

- Brazil is not supported.

- Only digital goods are supported.

Updated 7 months ago