Get Started with Calculation and Transaction Management

Learn about integrating your host system with the O Series Calculation and Transaction Management APIs.

About the O Series Tax Calculation API

Vertex® O Series web services via the Tax Calculation and Tax GIS API allow you to integrate O Series with your financial host system using REST requests and responses. There are requests for each type of financial event that you can process in O Series for both Sales and Procurement perspectives.

Use the Tax Calculation and Tax GIS API to:

- Perform Calculation calls on Sales transactions, including: Quotations, Invoices, and Distribute Tax calls.

- Perform Calculation calls on Procurement transactions, including: Accruals, Invoices, Distribute Tax calls, and Evaluated Receipts Settlement (ERS) calls.

- Perform Calculation calls on Owner transactions, including: Inventory Removal and Asset Movement.

Download OAS files

Download links for OpenAPI Specification (OAS) files in JSON format are available in the title of API Reference for all O Series APIs.

Use the <> API Reference button in the site header or any of these links to go to the API reference for the O Series APIs:

- O Series Calculation and Transaction Management API

- O Series Tax Configuration API

- O Series User Management API

- O Series Role Management API

URL for Tax Calculation and Tax GIS API endpoints

The server URL pattern for accessing Tax Calculation and Transaction Management endpoints uses this format:

<server:port>/vertex-ws/<version>/<endpoint>

where:

<server:port>identifies your network address.vertex-wsdesignates the Vertex O Series Transaction web service APIs.<version>is the version of the API.<endpoint>is the target of the interaction.

For example:

https://example.server.com:8095/vertex-ws/v2/supplies

Tax Calculation API endpoints

| Tax Calculation and Tax GIS API endpoint | Tax Calculation and Tax GIS API endpoint description |

|---|---|

/v2/supplies | POST - Represents tax calculation from the seller's perspective. Performs a calculation request based on the set property of the Sale Message Type. Valid values are Quotation, Invoice, or Distribute Tax. |

/v2/procurement | POST - Represents tax calculation from the buyer's perspective. Performs a calculation request based on the set property of the Purchase Message Type. Valid values are PurchaseOrder, InvoiceVerification, Accrual, DistributeTax, Evaluated Receipts Settlement (ERS), or Conditional Procurement. |

/v2/owner | POST - Represents tax calculation from the owner's perspective. Performs a calculation request based on the set property of the Owner Message Type. Valid values are Inventory Removal or Asset Movement. |

Transaction Management API endpoints

| Tax Calculation and Tax GIS API endpoint | Tax Calculation and Tax GIS API endpoint description |

|---|---|

/v2/transactions/{id} | DELETE - Deletes a transaction stored in the host system. |

/v2/transactions/{id}/reversal | POST - Creates a second transaction with negated taxability amounts to "reverse" the original transaction. |

/v2/transactions/{id}/rollback | POST - Reverts a transaction to its previous state after having been modified by an ARBillingSync , APInvoiceSync, or AccrualSync synchronization event. |

/v2/transaction-exists/{transaction id} | GET - Checks if the transaction with the specified transactionId exists. |

About the O Series Transaction Management API

The Transaction Management in O series through the Tax Calculation and Tax GIS API contains requests for interacting with transactions once calculation has already occurred.

Use the Tax Calculation and Tax GIS API to:

- Make Delete calls to delete a transaction stored in your host system.

- Make Reversal calls that refence an existing transaction and create a second transaction with negated taxability amounts to "reverse" the original transaction.

- Check if a transaction with a specified

transactionIdexists.

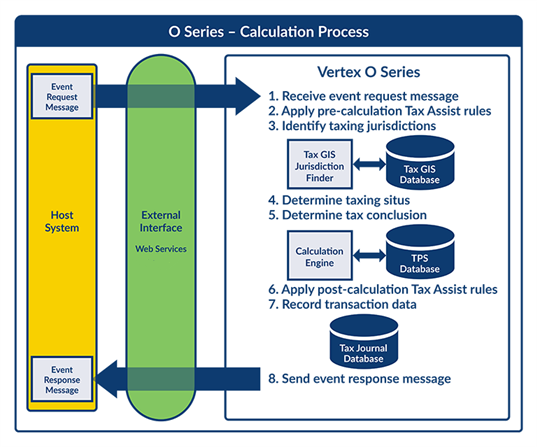

How O Series calculates tax

The Calculation service calculates tax, based on the financial event of the transaction, the tax jurisdictions identified in the transaction, and the tax situs. The Vertex Calculation Engine uses the tax rates and rules that are associated with these jurisdictions to determine the tax conclusion and to calculate a tax amount, and that information is included in the response.

- O Series receives the transaction request message from the host financial system through an external interface.

- TaxGIS identifies the tax jurisdictions for the transaction by using Tax Area IDs that are stored in the TaxGIS database.

- The Calculation Engine determines the jurisdiction with tax situs or place of supply.

- The Calculation Engine determines the tax conclusion and generates a response message.

- O Series writes the transaction results to the Tax Journal, as appropriate for the financial event.

- The financial system retrieves the transaction response message from O Series via the external interface.

Here's the flow of a transaction through the system:

Updated about 1 year ago