Getting Started with Vertex e-Invoicing

Learn how to use Vertex e-Invoicing to upload invoices for submission to tax authorities and transmission to buyers.

Introduction

Vertex e-Invoicing helps you to simplify VAT compliance globally, providing a single, scalable solution for managing real-time reporting and the creation, exchange, and clearance of e-invoices. By connecting with source financial systems, e-Invoicing streamlines electronic invoicing processes, helping to increase efficiency and reduce compliance risk.

The Vertex e-Invoicing REST API enables you to upload e-invoices and other Documents for processing according to the country mandate, including, submission to Tax Authorities and, in some countries, delivery to other parties like Buyers.

Documents is the collective term for the e-invoices and credit notes that you send to the service. For an overview of this and other terms, see the Glossary.

Vertex Universal Standard (VRBL)

Vertex Universal Standard (VRBL) is the name of the format that you must use to submit Documents.

The VRBL Basic Concepts topic and section provides an introduction to VRBL. This is part of the VRBL Developer's Guide Overview, which provides information about how to model your VRBL documents.

Prerequisites

Note

Vertex Community is a resource for Knowledge Articles, Training, Customer Forum, and Customer Support. Accessing Vertex Community requires login credentials. You can request login credentials on the Community, but you will need your company's account number. If you do not know your account number, contact your company's administrator or [email protected].

- Review the How e-Invoicing Works topic on Vertex Community.

- Review the Accessing e-Invoicing topic on Vertex Community.

- Review the API credential creation for e-Invoicing topic on Vertex Community.

- Vertex e-Invoicing API users can review the Send Document topic on this site for the requirements to upload files.

- Vertex e-Invoicing Messaging API users can review the Send a Message topic on this site for the requirements to upload files.

- Review the API Authentication and Access topic on this site to understand how to access the service's API.

Restrictions

- Some countries require specific elements and values. These are documented in the section for that country. For an example, see Malaysia MYS: Overview.

- B2C is not supported generally. It is for Taiwan. See Taiwan TWF: Overview.

- Some countries support B2B and B2G. Some only support B2G. See Supported Countries for details.

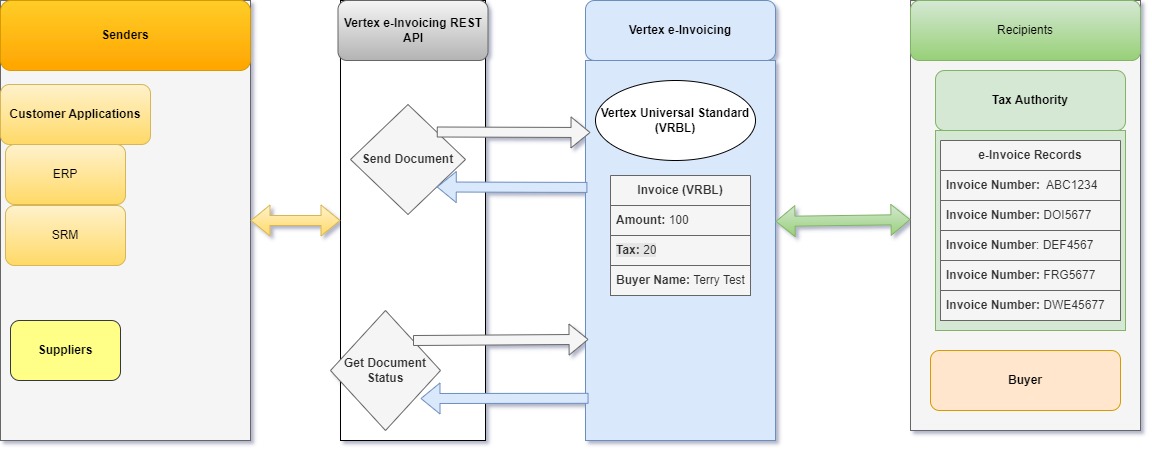

Component overview

The following graphic shows the components:

Components Overview

Vertex e-Invoicing consists of the following components:

- REST API: This is used to integrate the service with your applications. See Using the Vertex e-Invoicing API.

- Vertex e-Invoicing: The component that creates the invoice and submits it to the Tax Authority.

- Documents: Documents is the collective term for the e-invoices, credit notes, and other types that are sent to the Tax Authority electronically. See Document Modeling.

- Senders: Senders are parties who send Documents to Vertex e-Invoicing. These can originate from Suppliers or from the Vertex e-Invoicing customer's applications.

- Recipients: The party that receives a Document that is sent from Vertex e-Invoicing is known as a recipient. The following parties can be recipients:

- Tax Authority: The Tax Authority is the legal body responsible for collecting the e-invoices. They are the only recipient for most countries.

- Other Recipients: In some countries, other parties with compatible systems, such as Buyers, can receive Documents, so you can send to these in specific circumstances.

API overview

An overview of the API is provided in the Using the Vertex e-Invoicing API topic.

Integration

To integrate the service, complete the following steps:

- Retrieve your access token. See API Authentication and Access.

- Integrate the requests into your environment. See Using the Vertex e-Invoicing API.

- Use the Send Document request to send some sample files. You can get samples from the Example Files topic.

- Test your integration.

In this section

| Topic | Description |

|---|---|

| API Authentication and Access | You use an access token to authenticate requests. Before you do, you must ensure that you have the correct user credentials to retrieve the token. |

| Supported Countries | Read about the supported countries and regions. |

| Glossary | Read about terms that are used frequently in this documentation. |

| Copyright Notice | Read this copyright notice. |

| Release Notes | Read about releases. |

Updated 5 months ago